Month: January 2011

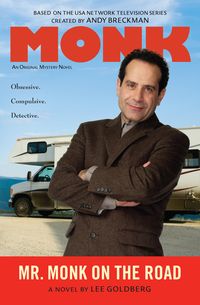

Mr. Monk on the Road Raves

Two rave reviews for MR. MONK ON THE ROAD just came my way, both from long-time fans of the books. Debra Hamel at Bookblog says, in part:

Goldberg’s books aren’t only about the crimes. More important are the series’s wonderful characters. The development of Monk and Natalie’s relationship over the series makes for many sweet moments, but in this outing the focus is on Ambrose’s interaction with Monk and Natalie and with the world at large. As usual in the series, there is some very funny dialogue. Usually this is centered on Monk’s abhorrence of all things unsanitary, but Ambrose’s social ineptitude also makes for some funny lines. I really enjoyed this one and the series as a whole, and I’m hoping the books never stop coming.

Ed Gorman liked it for a lot of the same reasons. He says, in part:

Lee Goldberg has cast the new and extremely enjoyable Monk book as a picaresque adventure.[…]I’ve given up trying to rank the Monk books. I’ve read them all and think they each have different pleasures to offer, which is a tribute to Lee’s savvy as a writer. But I have to say that putting both the Monks in a RV with Natalie-take-no-crap-Teeger has got to be the funniest premise yet. A truly hilarious read with a surprise shout-out to the movie “Duel” coming out of nowhere. Among many other surprises.

Thank you Ed and Debra for the great reviews and the continued support!

Hells Fargo

I want to share with you a Kafka-esque conversation I had today with a representative at Wells Fargo Bank.

But first, some background.

Back in December, my accountant pointed out that I'm apparently paying twice, through automatic withdrawals, for online banking each month. One payment is for $14.95 and is clearly listed as a Wells Fargo online banking fee…the other fee for $15.95 and is listed as an "Online Bill Payment Services Fee."

I called the bank and questioned them about the charges. They said that the ""Online Bill Payment Services Fee" wasn't from them. When they called the number associated with the account, they got "middle eastern music." So I had them put a stop payment on the withdrawal, effective immediately. They did that, said they would investigate the matter, and told me to call back in a couple of weeks for more details on who was taking my money.

So that's what I did. But when I called back, with my claim number and everything, the agent had no idea what I was calling about. I gave him the back story.

"Some entity calling itself 'Online Bill Payment Services" has been withdrawing fifteen dollars a month from my account," I said.

"That is correct. We have stopped that transaction. It won't happen again."

"That's great. Who are they?"

"A bank," he said.

"Your bank?" I asked.

"Another bank."

"Which bank?"

"I can't tell you that information," he said.

"Why not?"

"I can't answer that question," he said.

"Why not?"

"Because that's not my department," he said. "You will need to speak to another department."

"The department that answers questions?"

"I don't appreciate the tone of your voice," he said. "I will send the department a request. They will get back to you in three days. Or maybe more."

"With the name of the bank," I said.

"They might," he said. "Or they might not. They may not know, either."

I took a deep breath. "Okay. Is there anything stopping this other bank from just withdrawing a different amount of money from my account next month? Say, $15.97 or $1500?"

"No, there isn't"

"Can't you put a stop to any automatic withdrawals from my account from that other bank?"

"No, because it's not the bank that is withdrawing the money, but rather a person or business who has an account with them."

"Okay, now we're getting somewhere," I said. "Can you tell me the person or business that is that is taking my money?"

"No," he said.

"So how do I stop this person or business from making withdrawals from my account?

"You have to call Wells Fargo customer service and ask them to put a stop payment on all withdrawals from the person or business."

"But you won't tell me the name of the bank or the person or the business that is taking my money!"

"That is correct," he said. "You don't have to yell."

"I am closing my account," I said.

"It would be easier to put a stop payment on the person or business that is withdrawing your money."

"BUT YOU WON'T TELL ME WHO THEY ARE!"

"That is correct. Can I be of any more service to you today?"

UPDATE 1/25/2011: After that infuriating call, I took a "time out" and called Wells Fargo again. I spoke to a different representative, who was only slightly more helpful.

She was pleased to tell me they were reversing $47 in charges paid to whoever was taking my money. That's only a fraction of what I've lost, but okay, it's a step forward.

She went on to say that the withdrawal is coming from New York Clearing House on behalf of Mid-Peninsula Bank (which a quick web searched revealed was taken over by Wells Fargo in 2007).

She said that, short of me closing down my account, there was nothing they could do to help me prevent future unauthorized withdrawals from Mid-Peninsula Bank. Nor were they willing to help me figure out who at Mid-Peninsula Bank was withdrawing my money, nor were they willing to give me any information I could take to law enforcement to try to figure out who was taking my money.

So I closed my checking account and opened a new one. But because all of our other accounts are at Wells Fargo, and I didn't want the hassle of starting anew at another bank, I ended up staying there.

I went down to my local branch and had a new checking account in about ten minutes. Even so, I am not happy customer.

Would you rather be an enlightened barista or a working writer?

My brother Tod did an interview with the Association of Writers and Writing Projects blog about his approach to running the low residency MFA program in Creative Writing & Writing for the Performing Arts at the University of California, Riverside. This brief excerpt pretty much says it all:

Caleb J Ross: You said something at last year’s AWP which stuck with me. Paraphrased, of course, you said that you teach your MFA classes like an instructor of any trade program might, with the end goal of providing financial opportunities for the students. This seems like a radically different approach than most MFAs which may instead focus on non-definable, creative signposts to gauge student success. First, am I expressing your idea correctly? Second, how is this goal compromised by a low-residency program, if it even is?

Tod Goldberg: Pretty close. Essentially my philosophy is that if you’re in an MFA program, your goal isn’t to become the most well-read person on earth with a handful of literary quotes at your disposal at all times, it’s to be published. It’s to be produced. Graduate programs in creative writing are some of the few that seem entirely esoteric because they don’t seem to be training you for anything tangible, apart from maybe being a particularly enlightened barista, because, well, that’s frequently the case. But I think that has to change. Being a professional writer is a job. And if you want to write books, or write screenplays, or write poetry, simply for personal edification, you certainly don’t need an MFA program to do that. But if you want to become a professional writer, I think an MFA program can and should be a clear stepping stone in that direction. Most aren’t. Most entirely eschew the idea of life after the MFA — in fact, most programs tend to herald your acceptance into the program as the “making it” part of your writing career, which is silly. It’s school. It’s what you do afterward that makes a difference…

Is A Story Really Necessary?

This is a dramatization of an actual event.

Agent Scams

Victoria Strauss at Writer Beware offers an excellent primer today on how to spot, and avoid, literary representation scams. As it turns out, the sample solicitation she's using was sent by Dan Grogan, an ex-employee of Jones Harvest, a two-bit and particularly sleazy vanity press. Clearly, Dan learned from the best. Here's some of Victoria's warning signs to watch out for:

– Cold-call solicitation. Reputable agents will sometimes directly approach an author whose work they've seen and liked (and if so, will reference that work). But they don't rely on mass email solicitation to build their client lists.

– Multiple punctuation and spelling errors, both in the email and on the agency's website (missing apostrophes, "summery" for "summary," etc.). A literary agent should be able to write error-free English–and to proofread it once it's written.

– Claims of experience that can't be verified. There are more of these on the agency's website. Alleging "long term relationships with particular publishers and editors" or "connections in the film industry, publishing companies, and multi-media marketing companies" are meaningless without specifics. A real agent with real experience who wants to tout that experience will say exactly what it is (see, for instance, the staff bios at the Nelson Literary Agency, or those at the Waxman Agency).

– Promotion of services irrelevant to literary representation.Reputable agents help guide their clients' careers, but they don't typically double as "public relation [sic] representatives." And see this page of the agency's website, where they claim, among other things, to be able to provide an ISBN, list clients' books on Amazon, and "Copyright your work with the Nation [sic] Library of Congress." These are services important for self-publishers, but not relevant to authors expecting their agents to sell their books to reputable trade publishers. (And wouldn't you hope your agent would know that your work is copyrighted from the moment you write it down, and that what you do with the US Copyright Office–not with the Library of Congress–is register it?)

– A critiquing service for a fee. The publishing world is changing, and reputable agents are more and more branching out into other areas–including the provision of various paid services (I'm planning a post on that in the near future). However, offering a paid service to a potential client is a conflict of interest–never a good thing–and if you're cold-call soliciting that client, it suggests that maybe shilling the paid service is your main objective.

Zach Is Back

Back in the 1990s, my friend Zachary Klein wrote three terrific, widely-acclaimed mystery novels about substance abusing PI Matt Jacob ("Still Among the Living," "Two Way Toll," etc.) and then disappeared from the book scene. Until now. He's back with a new blog...and soon his out-of-print books will be showing up again on the Kindle (and, I hope, the unpublished fourth book in the series will follow, too). Here's an excerpt from his first blog post…

Back in the 1990s, my friend Zachary Klein wrote three terrific, widely-acclaimed mystery novels about substance abusing PI Matt Jacob ("Still Among the Living," "Two Way Toll," etc.) and then disappeared from the book scene. Until now. He's back with a new blog...and soon his out-of-print books will be showing up again on the Kindle (and, I hope, the unpublished fourth book in the series will follow, too). Here's an excerpt from his first blog post…

Creating fiction has always been crucial. Imperative, really, to keep my mother from slamming my ass with the telephone or frat paddle. To juke the rabbis in the Brooklyn Mirrer Yeshiva when they’d catch me in Greenwich Village or reading Playboy(just for the interviews, of course). Unfortunately my verbal dancing wasn’t always successful since I got thrown out before high school graduation. But no serious damage. I’d done well on the New York State Regents and had been accepted at the University of Wisconsin, Madison, before the toss. (Actually, everyone from the yeshiva did well. They made sure the collective marks were always high enough to keep their accreditation.)

Announcing Top Suspense

Here's the press release announcing TopSuspense, which just went out to media outlets this week.

Navigating the Sea of E-Books

Nine top suspense authors join forces to promote quality e-books www.TopSuspenseGroup.com

The e-book market is exploding. With over 700,000 e-books currently available and hundreds more added every week, it’s growing increasingly difficult to distinguish quality books from those that are unedited and written by inexperienced authors.

That’s why nine established, professional authors have formed Top Suspense Group, a site where readers are guaranteed to find top-notch, award-winning authors in multiple genres who deliver a great e-reading experience in their dozens of highly-acclaimed books.

"Readers can count on us," acclaimed author Max Allan Collins explains. "Every member of our group has already made his or her mark on genre fiction, whether it's noir, crime, mystery, thriller, horror or Westerns, and in some cases, several of these genres."

Top Suspense authors have each:

- Published multiple novels with traditional publishers

- Won or have been nominated for major literary awards

- Been internationally published

- Received critical acclaim from national publications

Many of the authors have graced the national bestseller lists and have had their work produced or optioned for film (the Oscar winning “Road to Perdition”) and television (the Emmy winning “Monk”). Our authors include:

Max Allan Collins · Bill Crider · Lee Goldberg · Joel Goldman · Ed Gorman · Vicki Hendricks

Paul Levine · Harry Shannon · Dave Zeltserman

This unique site provides a one-stop-shop of quality suspense fiction. As the e-book market continues to flood and overwhelm readers, Top Suspense will remain a succinct guide to quality, professional e-books written by today’s leading authors.